what is suta tax california

Who pays Suta in California. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

Llc Tax Rate In California Freelancers Guide Collective Hub

To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes. SUTA dumping is a tax evasion scheme where shell. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Employers with a positive reserve balance or those with a new employer tax rate will also be subject to the. Heres how an employer in Texas would calculate SUTA. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage.

The SUI taxable wage base for 2021 remains at 7000 per employee. Keep in mind that earnings exceeding 7000 are not taxed and it is the employer who pays this tax and not. The states SUTA wage base is 7000 per.

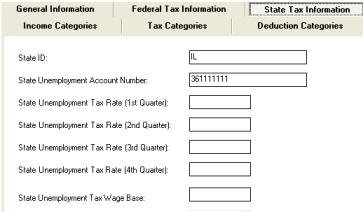

Employer registration requirement s. The new-employer tax rate will also remain stable at 340. 2021 SUI tax rates and taxable wage base.

Register immediately after employing a worker. PIT is a tax on the income of California residents and on income that nonresidents get within California. The state typically issues a SUTA tax.

If one of your employees ever. You might be interested. See Determining Unemployment Tax Coverage.

The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. According to the EDD the 2021 California employer SUI tax rates continue to. The amount of the tax is based on the employees wages and the states unemployment rate.

FUTA tax rate is 6 of the first 7000 paid to an employee annually. In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st. State unemployment tax is a percentage of an employees.

We work with the California Franchise Tax Board FTB to administer this program. Timeline for receiving unemployment tax number. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

Appealing A Denial Of Unemployment Benefits After A Wrongful Termination In California Odell Law Top Employment Lawyer In Los Angeles Orange County

1099 G Fill Online Printable Fillable Blank Pdffiller

2022 Federal State Payroll Tax Rates For Employers

What Are Employer Taxes And Employee Taxes Gusto

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Ca Unemployment 300 Boost Ui Peuc Pua Fed Ed Explained Abc10 Com

California Unemployment Debt How Will It Pay Off 20 Billion Calmatters

Georgia Payroll Tax Payroll Software

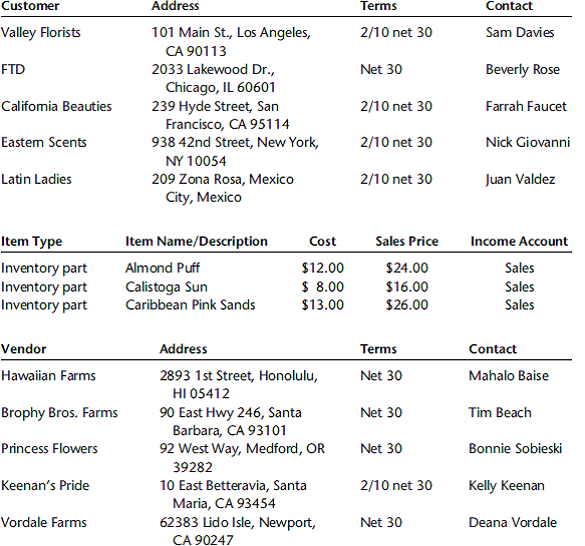

Ocean View Flowersocean View Flowers Is In The Wholesale D Chegg Com

Concrete Works Is A California Company With A Suta Chegg Com

You Have To Pay Taxes On Unemployment Checks What You Need To Know

Unemployment Benefits California How To Get The New Unemployment Checks Marca

How Much Does An Employee Cost In California Gusto

Unemployment Tax Changes Throughout The Country In 2022 And 2023 First Nonprofit Companies

Suta Tax Your Questions Answered Bench Accounting

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

Payroll Tax Vs Income Tax What S The Difference

Is California Blowing It On Unemployment Reform News Almanac Online